Belgium’s E-Invoicing Mandate Comes into Effect in Jan 2026: Is Your Business Ready?

From January 2026, all Belgian VAT-registered businesses will be required to adopt structured digital invoices for B2B transactions. This means no more paper invoices or PDF invoices will be legally accepted. Instead, companies must switch to e-invoicing that complies with the EN 16931 structured e-invoices format and the Peppol BIS standard Belgium. This marks a major shift in the way businesses operate, ensuring that Belgium aligns with the broader EU standards for e-invoicing.

This change matters for several reasons.

- It ensures that mandatory e-invoicing for businesses is fully compliant with Belgian VAT requirements.

- It eliminates inefficiencies associated with manual invoice handling, reducing errors and processing delays.

- It places Belgium at the forefront of digital transformation, where digital invoices Belgium businesses will enjoy smoother, more transparent, and standardized B2B transactions.

To comply with the new regulation, companies must adopt a Peppol Belgium e-invoicing system or equivalent e invoice software capable of meeting the structured e-invoices EN 16931 standard. Businesses should carefully evaluate e invoicing solutions, such as Odoo ERP, and e invoicing solution providers, such as Navabrind IT Solutions, to select the best e invoicing software suited to their size and budget, while also considering the e invoice software price.

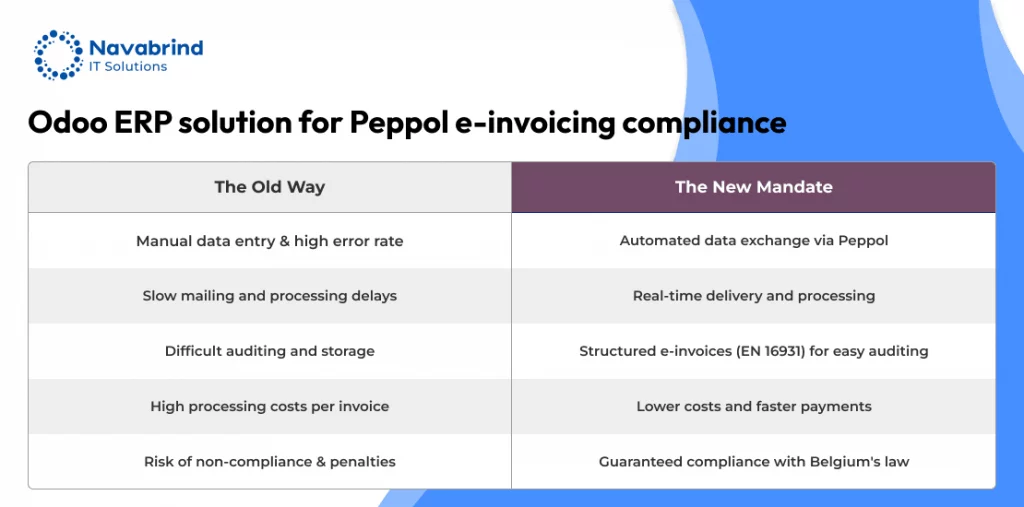

For many SMEs, the easiest way to prepare for Belgium e-invoicing 2026 is to integrate compliance directly into their ERP system. With its open architecture, Odoo ERP solution for Peppol e-invoicing compliance is a strong fit, as it can be customized to meet the Belgian mandate. By connecting Odoo ERP, businesses can even automate product and invoice data alongside their financial processes. This creates a future-proof e invoice system that not only ensures compliance but also boosts efficiency.

The upcoming transition is more than a legal requirement—it is an opportunity to modernize business operations. The question remains: is your business ready to comply with Belgium e-invoicing law 2026?

What the Belgian E-invoicing Law 2026 Entails

The new regulation introduces a fundamental change for all Belgian VAT-registered businesses. Paper and PDF formats will no longer be accepted. Instead, companies must adopt an e invoice system that generates and processes digital invoices Belgium in compliance with the European Standard EN 16931. This ensures consistency, interoperability, and transparency across the EU.

A key requirement of the law is the use of the Peppol Belgium network, which enables businesses to securely exchange invoices in a standardized manner. Invoices must follow the Peppol BIS standard Belgium, ensuring compatibility with the broader European peppol e invoicing framework. This means that every invoice, whether issued or received, must be transmitted in a structured format, eliminating the need for manual handling.

The law applies to all Belgian VAT-registered businesses, including local companies as well as foreign establishments operating in Belgium. Whether you are a large enterprise or a small startup, compliance is non-negotiable. Every einvoice must be processed digitally, ensuring integration into accounting systems and aligning with the EU’s push toward a fully digital economy.

Non-compliance carries serious risks. Businesses that fail to implement e invoicing solutions may face penalties, risk being denied VAT deductions, and suffer reputational damage in the eyes of partners and clients. There are also incentives for compliance: companies investing in e invoice software and automation may qualify for tax deductions and allowances, reducing the e invoice software price burden and making compliance an attractive investment.

To prepare, businesses should evaluate e invoicing solution providers and choose the best e invoicing software that fits their needs. Many are turning to ERP-based systems that incorporate Belgian VAT compliance software directly into their workflows. For example, Odoo ERP solution for Peppol e-invoicing compliance allows companies to integrate billing, accounting, and structured e-invoices EN 16931 seamlessly. When paired with Odoo ERP, businesses can even automate product and invoice data, and ensuring smooth reporting.

While the law requires businesses to move beyond basic digitization and embrace end-to-end automation. With the right tools, such as Odoo, companies can not only comply with Belgium e-invoicing law 2026 but also transform invoicing into a strategic advantage. The shift to mandatory e-invoicing for businesses is more than regulation—it’s an opportunity to adopt the best ERP solution for digital invoices in Belgium and future-proof operations for the long term.

What Businesses Need to Do

With Belgium e-invoicing 2026 becoming a legal requirement, companies must start preparing now to avoid last-minute challenges. The first step is to upgrade invoicing and accounting systems so they can issue and receive Peppol Belgium–compliant structured e-invoices EN 16931. Traditional tools that only generate PDFs will no longer suffice. Instead, businesses must implement an e invoice system or e invoicing solutions that can connect to the Peppol BIS standard Belgium network, ensuring invoices are legally valid, interoperable, and fully compliant.

Equally important is ensuring that these systems can both send and receive structured invoices. Outgoing invoices must be created in the correct format, while incoming invoices need to be automatically processed and integrated into company accounts. Choosing the best e invoicing software is therefore critical. Many organizations are evaluating e invoicing solution providers not only based on e invoice software price, but also on scalability, usability, and future-readiness. Businesses should look for Open source ERP USA platforms like Odoo ERP solution for Peppol e-invoicing compliance, which combine billing, accounting, and reporting in one system.

To make this transition successful, companies must train finance and operations teams on the new workflows. Staff should understand how to issue an einvoice, validate received digital invoices Belgium, and resolve any errors flagged by the e invoice peppol network. Training will reduce resistance, build confidence, and minimize delays once the mandate takes effect.

Another vital step is assessing supplier and customer readiness. Even if your company is compliant, disruptions may occur if partners are unprepared. Reviewing readiness across the supply chain ensures smooth adoption and avoids cash-flow issues. A proactive approach—communicating with vendors and clients about mandatory e-invoicing for businesses—will help align expectations well ahead of January 2026.

Every business should create a compliance checklist to ensure no requirement is overlooked. This includes selecting Belgian VAT compliance software, testing invoice flows through the Peppol e invoicing network, and verifying integration with existing tools. By preparing early, companies can avoid penalties and confidently answer the question of how to comply with Belgium e-invoicing law 2026.

Forward-thinking businesses are going beyond compliance and using this transition to automate product and invoice data with OdooPIM ERP. With Odoo, not only can businesses stay compliant with structured e-invoices EN 16931, but they can also streamline product catalogs, reduce errors, and speed up transaction cycles. This makes Odoo the best ERP solution for digital invoices in Belgium—a tool that goes beyond legal requirements to create long-term efficiency gains.

Preparing for e invoicing peppol Belgium is not just about ticking a compliance box. It’s about adopting smarter processes, aligning with EU digital standards, and transforming invoicing into a competitive advantage. The question remains: Is your business ready for mandatory electronic invoicing in 2026?

How Automation Can Help

Manual data entry and invoice preparation not only slow down operations but also increase the risk of errors. By using automated invoice generation tools within an e invoice system, companies can ensure that every einvoice is produced in the correct Structured e-invoices EN 16931 format. This prevents costly rejections from the Peppol Belgium network, and ensures businesses meet the requirements for mandatory e-invoicing for businesses.

Integration is another area where automation delivers huge value. With an Odoo ERP solution for Peppol e-invoicing compliance, invoices link directly with accounting, sales, and procurement modules. This means that when an order is placed or goods are delivered, an e invoice peppol can be automatically generated and transmitted, eliminating duplicate work and ensuring real-time synchronization. Businesses benefit from a fully connected ecosystem where digital invoices Belgium flow seamlessly between finance, operations, and compliance teams.

Automation also improves speed, accuracy, and audit readiness. With e invoicing solutions and Belgian VAT compliance software, invoices are validated instantly, VAT is calculated correctly, and all data is logged for future audits. Automated systems provide a clear audit trail, which is essential for tax inspections, compliance checks, and internal governance. For SMEs, adopting the best e invoicing software is not just about compliance—it’s about unlocking efficiency gains that free up time for growth-focused activities.

Real-time reporting is another major advantage. Automated e invoicing peppol Belgium systems can generate compliance dashboards, highlight discrepancies, and provide insights into invoice processing status. This helps businesses not only stay VAT-compliant but also anticipate cash flow challenges. Instead of waiting for end-of-month reconciliations, CFOs and managers get real-time visibility across all transactions, ensuring quick responses to any anomalies.

Forward-thinking businesses can take automation a step further by leveraging Odoo ERP. This allows them to automate product and invoice data with OdooPIM, ensuring product catalogs, pricing, and invoice lines are always accurate and up to date. Such integration reduces manual reconciliation, improves customer satisfaction, and helps avoid disputes over incorrect invoices. The combination of Odoo ERP with Peppol compliance makes it the best ERP solution for digital invoices in Belgium—a platform that’s customizable, scalable, and fully aligned with EU standards.

In essence, automation is the bridge between compliance and efficiency. By adopting e invoicing solution providers with strong automation capabilities, businesses can reduce administrative burdens, accelerate invoice cycles, and stay fully prepared for how to comply with Belgium e-invoicing law 2026. It’s not just about surviving the transition—it’s about using this legal shift to build a smarter, more resilient financial backbone.

Is Your Business Ready for This Change?

With the e-invoicing mandate fast approaching, operationally, relying on outdated systems or manual processes may cause invoices to be rejected. From a competitive standpoint, companies that fail to modernize with e invoice software or e invoicing solutions could fall behind peers who leverage automation for efficiency and real-time insights.

On the other hand, preparing now positions businesses for success. Adopting the best e invoicing software and Belgian VAT compliance software ensures not only legal compliance but also operational excellence. Modern e invoice systems can integrate with accounting, procurement, and ERP platforms, making processes faster and more reliable. For SMEs in particular, automation with Odoo ERP solution for Peppol e-invoicing compliance offers an affordable, customizable, and future-proof approach. With Odoo, businesses can even automate product and invoice data with Odoo, streamlining catalog management alongside invoicing.

This is not just a compliance project—it’s a strategic opportunity to digitize your financial operations. By working with experienced e invoicing solution providers, you can cut down on manual tasks, minimize errors, and strengthen your financial reporting. Whether you’re considering the e invoice software price, evaluating e invoicing peppol Belgium solutions, or searching for the best ERP solution for digital invoices in Belgium, the time to act is now.

At Navabrind IT Solutions, we help companies prepare for how to comply with Belgium e-invoicing law 2026. With our expertise in Odoo ERP and Odoo ERP, we design tailored solutions that meet both technical requirements and business needs. Our team ensures that your systems are Peppol-ready, VAT-compliant, and capable of scaling with your business.

Need help ensuring you stay compliant? Don’t wait until it’s too late. Prepare your Belgian business for mandatory electronic invoicing today. Reach out to Navabrind IT Solutions to discover how we can help you implement the right e invoicing software and automation tools to stay compliant and competitive.

Why Odoo is the Right Solution

When it comes to preparing for e-invoicing mandate 2026, businesses need more than just compliance—they need a flexible, scalable, and future-proof system. This is where Odoo ERP stands out as the best ERP solution for digital invoices in Belgium. With built-in support for einvoicing, tax compliance, and Peppol Belgium integrations, Odoo already provides the foundation for mandatory e-invoicing for businesses. Companies can issue and receive e invoice peppol documents that comply with Structured e-invoices EN 16931 and the Peppol BIS standard Belgium, ensuring smooth communication with customers, suppliers, and government systems.

One of Odoo’s greatest advantages is its open architecture. Unlike rigid ERP software, Odoo can be customized extensively to meet the specific requirements of Belgian VAT rules and the new digital invoicing framework. Businesses can integrate Belgian VAT compliance software directly within Odoo, making it easier to comply with evolving regulations. With the ability to adapt modules and workflows, Odoo ensures companies stay ahead of compliance deadlines and align seamlessly with how to comply with Belgium e-invoicing law 2026.

Odoo also offers unmatched integration capabilities. As an e invoice system, it connects with accounting, procurement, inventory, and CRM—providing a single source of truth across all financial and operational data. This level of integration not only streamlines invoice management but also reduces redundancy, improves accuracy, and creates real-time insights. Businesses can even automate product and invoice data with OdooPIM, ensuring that product catalogs, pricing, and invoice details stay synchronized, reducing errors and improving customer satisfaction.

Scalability is another key reason why Odoo is the ideal choice. Whether you’re a small Belgian SME just transitioning to digital invoices Belgium or a large enterprise handling thousands of invoices monthly, Odoo grows with your needs. Its modular structure means you can start small—with only the essential e invoicing solutions—and expand to include advanced features like analytics, AI-driven reporting, or integrations with third-party e invoicing solution providers. This makes Odoo not only a compliance tool but a long-term partner in digital transformation.

Cost-effectiveness further strengthens Odoo’s position. While many ERP systems require significant upfront investment, Odoo delivers deep functionality at a fraction of the e invoice software price of traditional platforms. Businesses can leverage both the free Community edition and the feature-rich Enterprise edition to match their budget and compliance requirements. When compared with other best e invoicing software options, Odoo strikes the balance between affordability and advanced capability, making it the best ERP solution for digital invoices in Belgium.

Odoo is not just an Odoo ERP solution for Peppol e-invoicing compliance—it’s a strategic investment. It enables companies to prepare for mandatory e-invoicing for businesses, remain agile as regulations evolve, and unlock efficiency gains through automation. With Navabrind IT Solutions as your implementation partner, you can ensure a seamless transition, full compliance, and a system that continues to add value long after 2026.

Preparing for Belgium’s 2026 E-Invoicing Mandate

The Belgium e-invoicing 2026 mandate is more than just a compliance obligation—it marks a turning point for businesses to modernize their operations and embrace true digital transformation. Businesses that act early will not only avoid the risks of non-compliance but will also gain significant operational advantages. By adopting the best e invoicing software, leveraging e invoicing solutions, and connecting with trusted e invoicing solution providers, companies can increase efficiency, improve accuracy, and ensure collaboration with customers and suppliers. With automation, real-time reporting, and integration through e invoice software and e invoice systems, Belgian companies can turn a legal mandate into a long-term advantage.

This is where Odoo ERP proves to be the best ERP solution for digital invoices in Belgium. With built-in e invoice peppol support, Belgian VAT compliance software integration, and the ability to automate product and invoice data with OdooPIM, Odoo ensures your business is fully aligned with mandatory e-invoicing for businesses. Its open architecture allows customization for specific legal needs, making compliance with how to comply with Belgium e-invoicing law 2026 simple and future-proof. Whether you’re an SME or a large enterprise, Odoo provides scalability, affordability, and the right digital backbone to evolve with your growth.

At Navabrind IT Solutions, we specialize in helping businesses prepare for mandatory electronic invoicing in Belgium. With our expertise in Odoo ERP solution for Peppol e-invoicing compliance, we make the transition seamless—ensuring you stay compliant while building a smarter, more efficient financial infrastructure.

Don’t wait until 2026 to adapt. Act now. With Navabrind IT Solutions as your partner and Odoo ERP as your platform, compliance becomes effortless, and digital transformation becomes your competitive edge.

Frequently Asked Questions

1. How to Comply with Belgium E-Invoicing Law 2026

Complying with Belgium’s mandatory e-invoicing law, which will be phased in from 2026, requires businesses to fundamentally shift their invoicing processes from manual or unstructured methods to a fully digital, standardized workflow. The core of the regulation mandates that all B2B invoices be exchanged electronically in a structured format that complies with the European EN 16931 standard, and the designated network for this exchange is Peppol (Pan-European Public Procurement Online). To achieve Belgian VAT compliance, businesses must first ensure their e-invoice software can generate invoices in the specific Peppol BIS (Business Interoperability Specification) format. This is not merely sending a PDF via email; it involves sending a machine-readable XML file through a certified Peppol Access Point provider, which then securely delivers it directly into the customer’s financial system, ensuring data integrity and automatic processing.

The journey to compliance involves several key steps. First, a business must select and integrate a compliant e-invoicing solution. This involves choosing between dedicated e invoicing solution providers or a comprehensive ERP solution like Odoo that has built-in Peppol e-invoicing capabilities. The chosen system must be able to generate the correct XML structure, connect to a Peppol network, and include all legally required fields as per Belgian law. Secondly, internal processes need to be adapted. This includes obtaining the customer’s Peppol ID (a unique identifier for their network address) and potentially cleansing master data to ensure accuracy, as automated systems will rely entirely on this digital information. For businesses managing large product catalogs, leveraging an OdooPIM (Product Information Management) system can be invaluable to automate product and invoice data, ensuring the information flowing into your invoices is consistent, accurate, and rich.

Preparing for the Belgium e-invoicing 2026 deadline is not just a legal obligation but a significant opportunity for operational improvement. Proactive preparation is crucial. Businesses should start auditing their current invoicing workflows, evaluating potential e invoicing solutions, and engaging with their software vendors to understand their roadmap for compliance. By adopting a modern e invoice system early, Belgian businesses can streamline their accounts receivable and payable processes, reduce manual errors, accelerate payment cycles, and ensure seamless adherence to the new mandate, turning a regulatory requirement into a competitive advantage.

2. Which is the Best ERP Solution for Digital Invoices in Belgium

When determining the best ERP solution for digital invoices in Belgium, the key criterion is its native ability to handle the upcoming legal requirements seamlessly, specifically full integration with the Peppol network for structured e-invoices. A top contender that meets this need effectively is Odoo ERP. Odoo stands out because it is not just an accounting tool but a fully integrated business management platform. Its significant advantage for Belgian e invoice compliance is its built-in Peppol network connector, allowing users to send and receive Peppol-compliant digital invoices Belgium requires directly from the Odoo Accounting or Invoicing app without needing complex third-party integrations or middleware. This native functionality ensures that generating EN 16931-compliant invoices and exchanging them via the mandated Peppol standard is a core, streamlined feature of the workflow.

Beyond mere compliance, the best e invoicing software within an ERP should enhance efficiency and data accuracy. Odoo excels here through its powerful integration with its own OdooPIM module. This allows businesses to automate product and invoice data at the source. Accurate, standardized, and enriched product information from the PIM flows directly into the invoicing module, eliminating manual data entry errors and ensuring that every invoice line item is correct and professionally presented. This synergy between the product database and the financial system is crucial for maintaining clean records and automating the end-to-end process from sale to invoice, which is a core benefit of a truly integrated ERP solution.

While e invoice software price is always a consideration, the value of an all-in-one system like Odoo often outweighs the cost of managing multiple disparate systems for e-commerce, CRM, inventory, and now mandated e-invoicing. For Belgian businesses looking to prepare for mandatory electronic invoicing, choosing Odoo provides a future-proof e invoicing solution that handles compliance out-of-the-box while also offering a scalable platform for all other business operations. Its comprehensive approach, combining Peppol compliance, integrated PIM, and full ERP functionality, makes Odoo a premier choice for businesses seeking a single e invoicing solution to meet the Belgium e-invoicing 2026 deadline and beyond.

3. How to Automate Product and Invoice Data with OdooPIM

Automating product and invoice data with OdooPIM (Product Information Management) begins by establishing a single source of truth for all product information. The OdooPIM module acts as a central hub where you can manage, enrich, and standardize all attributes of your products—from descriptions, dimensions, and images to supplier information, barcodes, and tax codes. This process is foundational for automation because high-quality, structured input data is essential for generating accurate output. By leveraging OdooPIM, businesses can automatically populate product data across their entire ecosystem, including their e-commerce website, sales orders, purchase orders, and, most critically, their invoices. This eliminates the need for manual, error-prone data re-entry between departments, ensuring that the information on a sales order perfectly matches the description and price on the final invoice.

The direct automation to invoicing is where the OdooPIM and ERP integration delivers significant value. Once a product is accurately defined in the PIM with all necessary financial attributes (like income account, taxes, and cost), this data is automatically pulled into the invoice creation process. When a salesperson creates a quotation or a sales order, they simply select the product from the centralized catalog. The system auto-fills the description, unit of measure, price, and applicable VAT rate. Once the order is confirmed and delivered, generating the invoice is a one-click operation. The resulting digital invoice is populated with precise, consistent, and rich product data directly from the Odoo PIM, ensuring compliance and professionalism. This seamless flow automates product and invoice data from end-to-end, drastically reducing errors, speeding up the billing cycle, and enhancing reliability.

Furthermore, for businesses dealing with multiple suppliers or complex categories, OdooPIM can automate data enrichment through import templates and validation rules. This means you can bulk-update product information or set rules to ensure all required fields are complete before a product can be made sellable. For Belgian VAT compliance, this is crucial, as you can ensure every product has the correct Belgian VAT tax code applied within the PIM. This guarantees that every structured e-invoice generated by the system will have accurate tax calculations from the start, forming a robust foundation for meeting stringent audit requirements. This level of automation ensures that your business is not only efficient but also inherently compliant.

4. How to Prepare Your Belgian Business for Mandatory Electronic Invoicing

Preparing your Belgian business for mandatory electronic invoicing requires a proactive and strategic approach well before the 2026 deadline. The first and most critical step is to understand that compliance means moving beyond PDFs and paper. The law mandates the exchange of structured e-invoices in the EN 16931 format via the Peppol network. Therefore, your preparation must begin with a thorough audit of your current invoicing process. Identify how you create, send, receive, and process invoices today. Then, you must evaluate your existing software. Can your current e invoice system generate Peppol BIS-compliant XML files and connect to a Peppol Access Point? If not, you will need to research and select new e invoicing solutions. This involves comparing e invoicing solution providers, considering the best e invoicing software, and understanding the e invoice software price to budget for this necessary investment.

Selecting the right technology is the cornerstone of compliance. For many businesses, the most efficient path is to choose an integrated ERP solution that has built-in Peppol capabilities, such as the Odoo ERP solution for Peppol e-invoicing compliance. An all-in-one system like Odoo eliminates the need for complex integrations between separate accounting software and a third-party e-invoicing service. It allows you to generate compliant digital invoices directly from your sales orders and send them via Peppol with a few clicks. This integration ensures that your invoicing data flows automatically from the initial sale, through inventory, and into the final invoice, maintaining data integrity and streamlining the entire order-to-cash process. Implementing such a system well in advance is vital to allow time for migration, testing, and staff training.

Beyond software, preparation involves internal process adaptation and data management. You will need to collect the Peppol IDs of all your Belgian B2B customers and suppliers to facilitate seamless digital exchange. This is also the perfect time to cleanse your master data—ensuring your company information, product codes, and customer details are flawless, as automated systems will propagate any errors instantly. Utilizing a tool like Odoo PIM can be a key part of this, helping you automate product and invoice data for accuracy. Finally, engage with your accounting team and stakeholders to train them on the new processes. By taking these steps—auditing, selecting the right Belgian VAT compliance software like Odoo, cleansing data, and training your team—you can ensure a smooth transition and turn the mandate into an opportunity for greater efficiency and automation.

5. Explain about Odoo ERP solution for Peppol e-invoicing compliance

The Odoo ERP solution for Peppol e-invoicing compliance offers an integrated approach for businesses preparing to meet Belgium’s mandatory e-invoicing requirements, effectively functioning as both a comprehensive ERP and a built-in e invoice software. Unlike standalone e invoicing solutions that require complex and costly third-party integrations, Odoo features native support for the Peppol network, which is the mandated infrastructure for exchanging structured e-invoices under the Belgium e-invoicing 2026 law. This means that within a single platform, users can generate invoices that automatically comply with the EN 16931 standard and the Peppol BIS format—the technical requirements for ensuring interoperability across Europe. By serving as an all-in-one e invoice system, Odoo eliminates the need for businesses to juggle multiple systems, reducing implementation complexity and ensuring smoother Belgian VAT compliance.

A significant advantage of using Odoo for e-invoicing is its ability to automate product and invoice data through tight integration with its OdooPIM (Product Information Management) module. Accurate and standardized product data—including descriptions, pricing, tax codes, and units of measure—is central to generating compliant digital invoices. With OdooPIM, product information is maintained in a centralized catalog, ensuring consistency across sales, inventory, and accounting modules. When an invoice is created, the system automatically pulls validated data from the PIM, applying correct VAT rules and formatting it according to the Peppol BIS standard. This end-to-end automation minimizes manual entry, reduces errors, and accelerates the invoicing process, making Odoo one of the best e invoicing software choices for businesses seeking both efficiency and compliance.

For Belgian businesses, selecting Odoo isn’t just about adopting software—it’s about investing in a scalable e invoicing solution that grows with regulatory demands. While some e invoicing solution providers offer niche services, Odoo provides a unified platform that aligns with broader business operations—from CRM and inventory to accounting and now Peppol e-invoicing. When evaluating e invoice software price, companies will find that Odoo’s integrated approach often proves more cost-effective than managing disparate systems. Its built-in Peppol capabilities allow companies to easily send and receive Belgium e invoices, prepare audit trails, and ensure full transparency. For any organization looking to prepare your Belgian business for mandatory electronic invoicing, Odoo represents a future-proof ERP solution that simplifies compliance while enhancing operational productivity

Schedule a conversation with us now!

written by

Venkadesh Nagarajan

Venkatesh Nagarajan is the Founder and Chief Technology Officer at Navabrind IT Solutions, where he oversees digitalization, solution design, and automation for hundreds of customers. He is responsible for implementing the company’s full portfolio of solutions on platforms such as Odoo, Magento, Akeneo, and OdooPIM. As a techno‑functional consultant, he excels at understanding clients’ business needs and designing tailored solutions that deliver significant business value. He ensures that every client engagement is executed using industry best practices, with a focus on personalization, innovation, and adherence to budget and timelines. Venkatesh leads a team of highly skilled solution architects, developers, and project managers who are engaged in implementing, integrating, customizing, maintaining, and supporting clients across industries, including e‑commerce, retail, automotive, electronics, manufacturing, engineering, healthcare, IT and BPM, real estate, and textiles.

Related Articles

-

Post

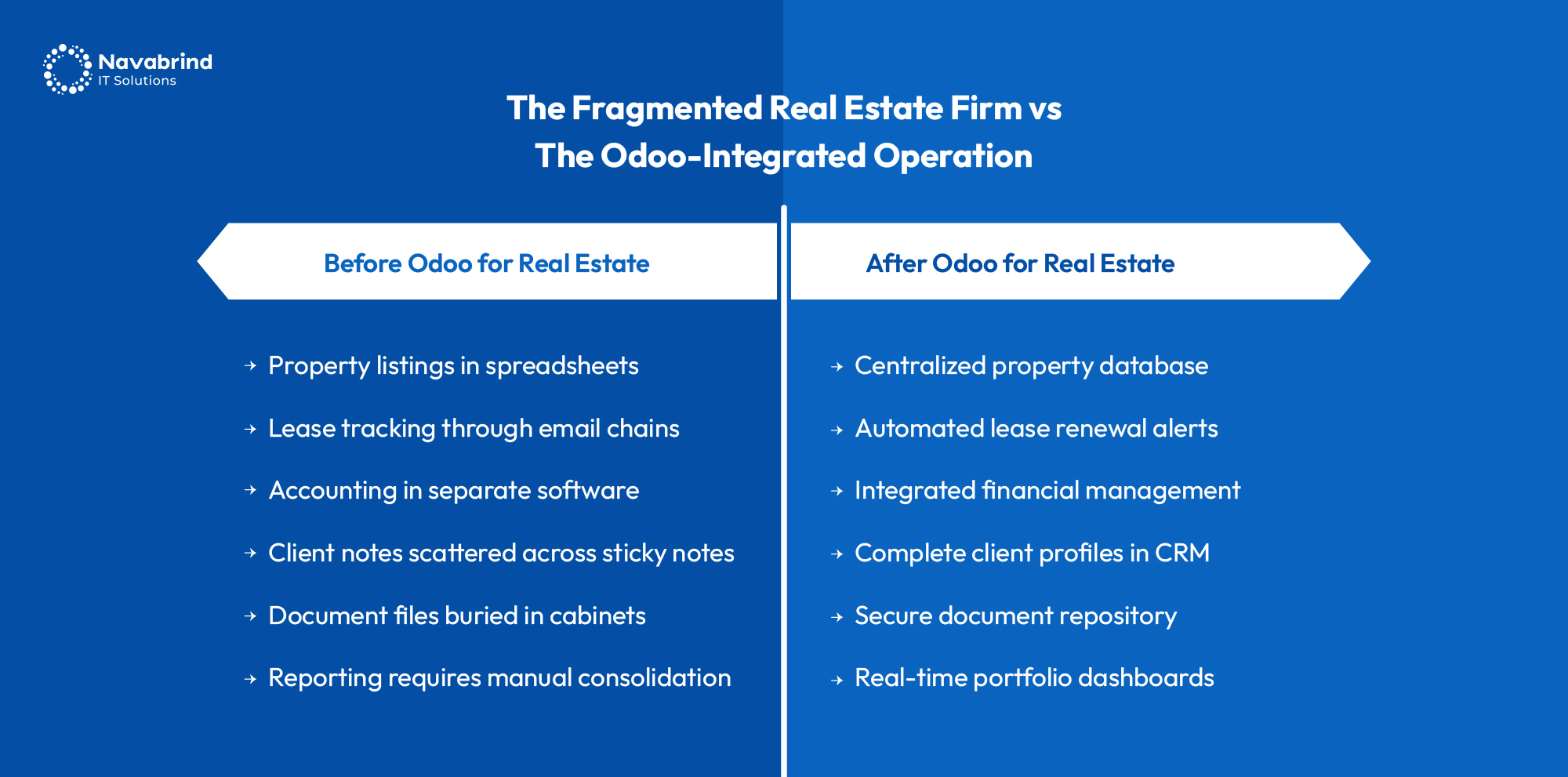

From Property to Profits: The Odoo ERP Blueprint for Real Estate

From Property to Profits: The Odoo ERP Blueprint for Real Estate March 6, 2026 Posted by: Abinay Subramaniam P Categories: Blog, Odoo ERP for Real Estate No Comments Real estate professionals juggle property listings, tenant leases, client inquiries, agent commissions, and complex financial transactions daily. Spreadsheets and disconnected software create chaos, not control. Information lives -

Post

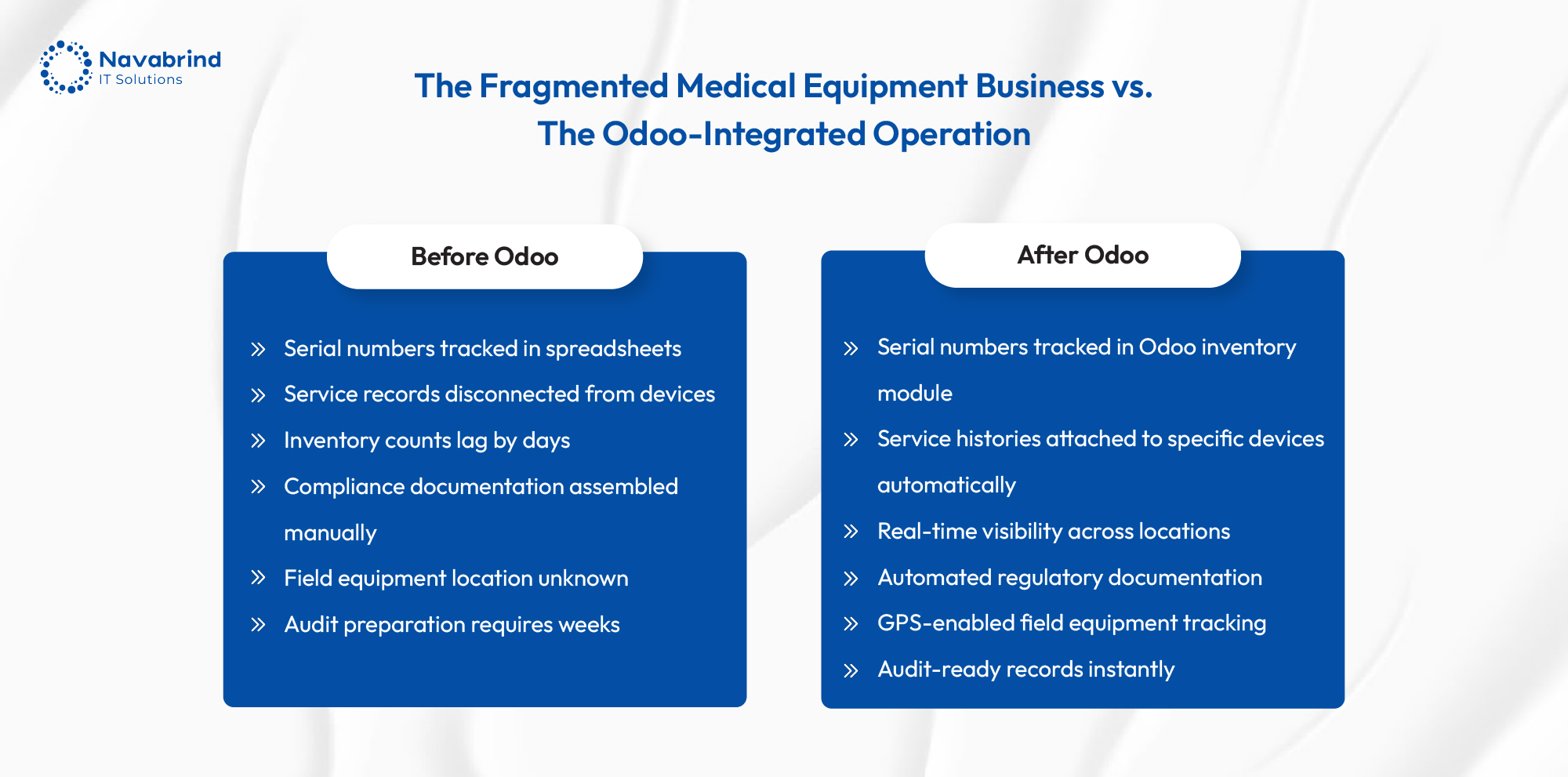

The Hidden Engine of MedTech: How Odoo Transforms Health Equipment Management

The Hidden Engine of MedTech: How Odoo Transforms Health Equipment Management March 2, 2026 Posted by: Sumit Sinha Category: Uncategorized No Comments Medical equipment businesses operate across multiple fronts, sales to hospitals, rental contracts with clinics, service agreements, and wholesale distribution to dealers. Managing these as separate functions creates chaos. Service records live in spreadsheets -

Post

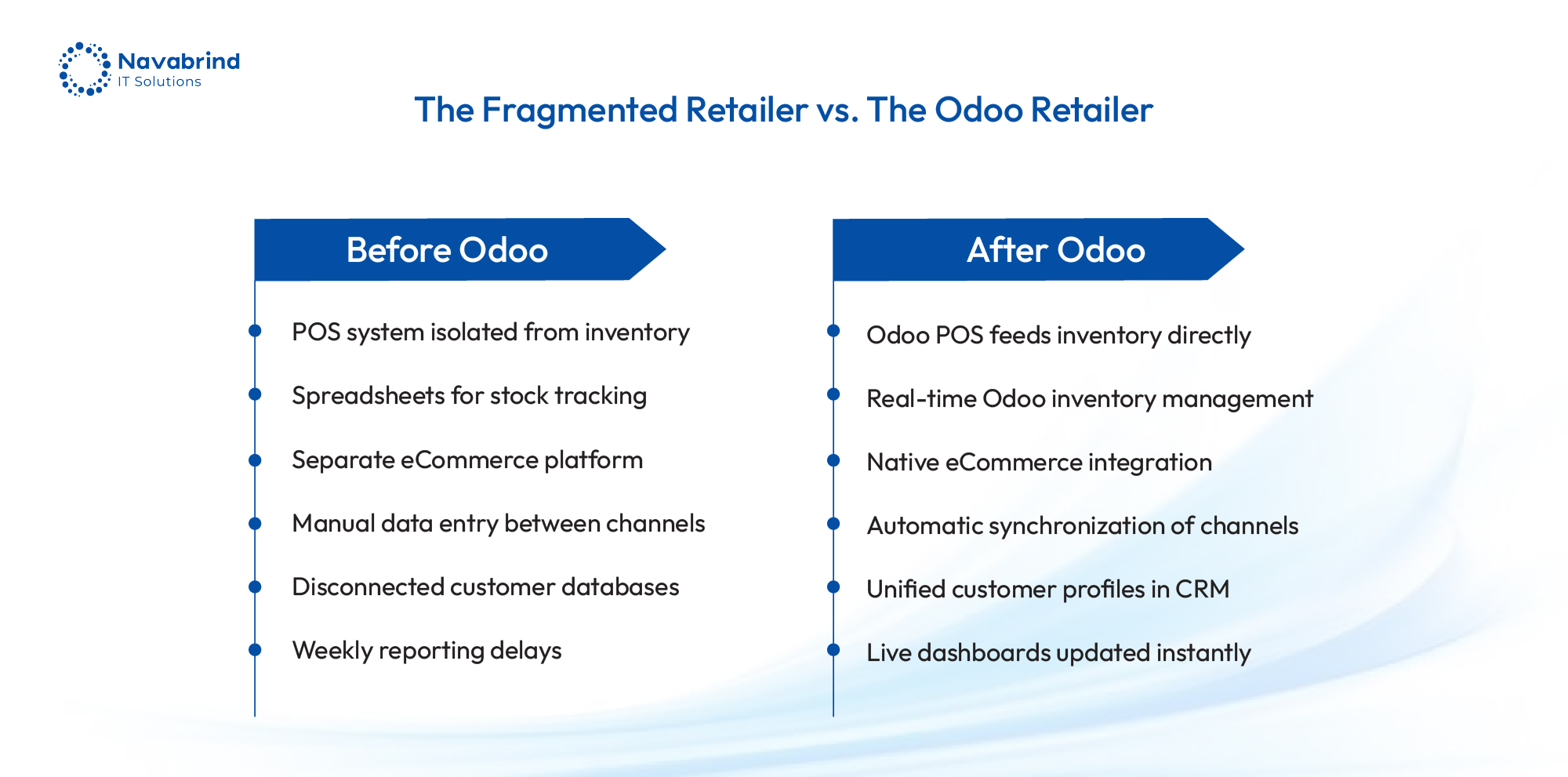

Odoo ERP for the Retail Industry: Driving Efficiency and Growth

Odoo ERP for the Retail Industry: Driving Efficiency and Growth February 27, 2026 Posted by: Vasanth Anantharaman Categories: Blog, Odoo for Retail industry No Comments Why the Retail Industry Runs Better on Odoo ERP Retail runs on dozens of disconnected apps. One tool for sales, another for stock, a third for loyalty. None speak to

written by

Venkadesh Nagarajan

Venkatesh Nagarajan is the Founder and Chief Technology Officer at Navabrind IT Solutions, where he oversees digitalization, solution design, and automation for hundreds of customers. He is responsible for implementing the company’s full portfolio of solutions on platforms such as Odoo, Magento, Akeneo, and OdooPIM. As a techno‑functional consultant, he excels at understanding clients’ business needs and designing tailored solutions that deliver significant business value. He ensures that every client engagement is executed using industry best practices, with a focus on personalization, innovation, and adherence to budget and timelines. Venkatesh leads a team of highly skilled solution architects, developers, and project managers who are engaged in implementing, integrating, customizing, maintaining, and supporting clients across industries, including e‑commerce, retail, automotive, electronics, manufacturing, engineering, healthcare, IT and BPM, real estate, and textiles.

How can we help you?

Get in touch with a solutions consultant that can share best practices and help solve specific challenges.